As generative AI technology continues to evolve, the market has become the focus of global attention. Generative AI is rapidly transforming the traditional way of video production, and showing strong potential for content innovation and market demand in areas such as social media, online education, and advertising and marketing.

Based on authoritative data such as market size, development trend and regional market share, this report provides readers with an in-depth analysis of the current status, and future development direction of the Generative AI market, providing a comprehensive industry research reference.

In this article:

Part 1. Generative AI Market Size and Forcast of Global and Region

The Generative Artificial Intelligence market is growing in size, and the overall size of the global market, and the growth characteristics of the regional markets are explored below for a better understanding of its strong performance.

1 Total Market Size and Forcast

Generative AI is ushering in an era of rapid growth and continues to expand due to the global market and multiple demand drivers.

- 2023: The global market size is expected to reach USD 20.48 billion.

- 2024: It is expected to grow to USD 36.06 billion.

- It is expected to grow at an estimated CAGR of 46.47% during the forecast period of 2024 to 2030.

- 2030: The market size is expected to reach USD 356.1 billion.

The table below summarises the dynamics of the market size from 2020 to 2030 in order to provide a more intuitive understanding of the extremely rapid growth of generative AI.

Data Sources: Statista

Note: Data have been converted from local currencies using the average exchange rate for the corresponding year.

2 Region Market Share and Forecast

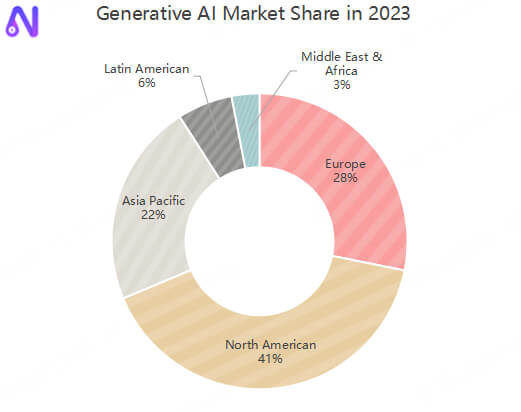

The major regions of the global Generative AI market comprise North America, Europe, and Asia Pacific, and the major regions hold the global Generative AI market share in 2023, as shown in the figure below.

Data Sources: Precedence Research

These key regions will also continue to grow in the future and lead the global market, based on their CAGRs, the size of which is forecasted to be as follows in 2033.

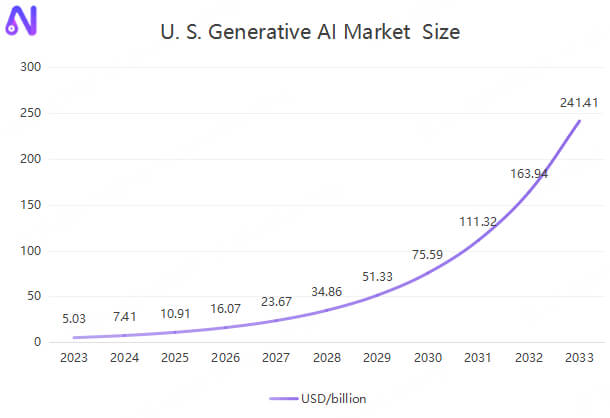

- North America - market share: 40.64%, market size: $5.03 billion, by 2023.

- Forecast CAGR of 47.3% from 2024 to 2033.

- Forecast U.S. market size in 2033: $241.41 billion.

- The second is the European market, which holds 28.11% of the market share in 2023.

- U.K. market share in 2023: 24.8%, with a projected CAGR of 28.4% from 2023 to 2033, and the U.K. market size will reach $15.2 billion by 2033.

- Germany Market Size Forecast to 2033: $14.9 billion, growing at a CAGR of 26.1% during the forecast period of 2023 to 2033.

- Asia Pacific - Global market share in 2023: 22.2% but is expected to grow at the fastest CAGR during the forecast period 2024 to 2032.

- China market is growing at a CAGR of 43.5% from 2024 to 2033, and is forecast to be $19.4 billion by 2033.

- The Indian market is forecast to grow at a CAGR of 31.8% from 2023 to 2033, with a projected size of $13.2 billion in 2033.

Data Sources: Precedence Research

Data Sources: Grand View Research & Future Market Insights

Part 2. Generative AI Market Segmentations

The generative artificial intelligence covers a wide range of components, platforms, and services, and the following section will focus on analyzing its market structure and major industry applications.

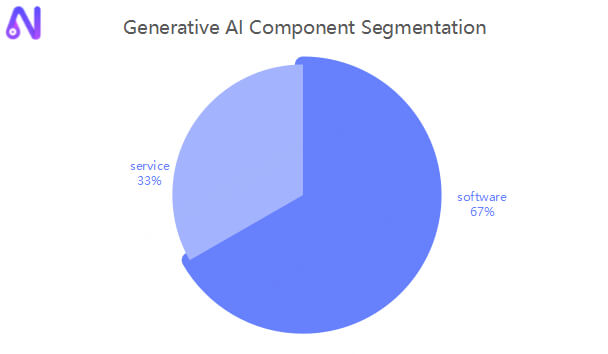

1 By Component

By component, the software sector, and the services sector. Software and services are triggering significant attention in the chain of generative AI, and the growth trends of both are directly reflecting the overall development trends of the market.

- The software segment accounted for more than 65.50% of revenue share in 2023.

- The services segment will account for 34% of the market revenue share in 2023.

Data Sources: IoT Analytics

2 By Models and Platforms Segmentation

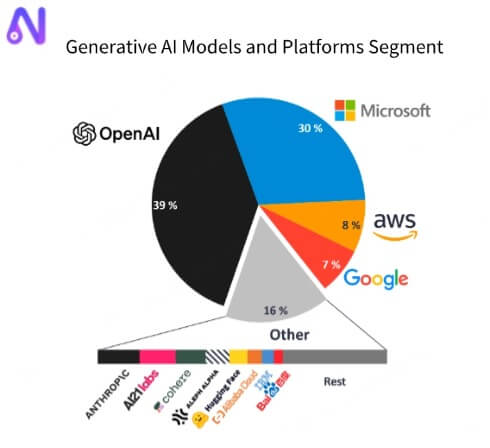

Various underlying models and platforms are the core force driving the adoption of generative artificial intelligence, and their market performance reflects technological innovation, and changes in the competitive landscape.

- OpenAI leads with 39% market share and the launch of ChatGPT in November 2022 has significantly boosted the industry.

- Microsoft holds the second largest market share with Microsoft Azure AI platform with 20,000+ active customers and 20% market share in 2023.

- AWS, which holds an 8% share of this generative AI market, quickly claimed third place in this market with the public launch of its Bedrock service in September 2023.

Data Sources: IoT Analytics

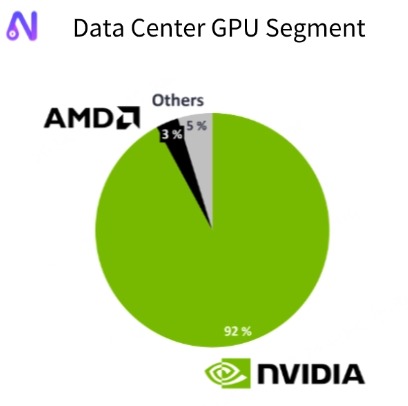

3 By Data Center GPU

The data center GPU market, which refers to dedicated GPUs designed to handle the massive computational demands of modern data centers, which are the backbone of generative AI, is set to reach $49 billion in 2023, a significant increase from 2022, according to the report.

- VIDIA leads the datacentre GPU market with 92% market share, and 2023, the company's quarterly revenue grew 272% in 2023.

- US semiconductor company AMD's data center segment grew 21% from Q2, 2023 to Q3, 2023, and now holds a 3% market share.

Note: This market does not include CPUs, consumer GPUs, or TPUs.

Data Sources: IoT Analytics

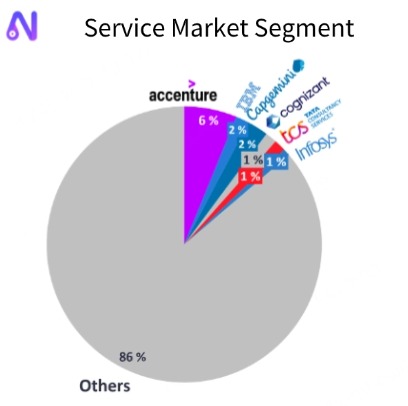

4 By Service Market

The generative AI services market is a specialist area of consulting, integration, and implementation support for organizations aiming to integrate generative AI capabilities.

- Accenture holds the largest share of 6% in the generative AI services market, with revenues from the company's generative AI projects set to grow to $300 million by 2023.

- US technology company IBM holds 2% of the market.

- France-based IT services company Capgemini also has a 2% share of the market.

Data Sources: IoT Analytics

4 By Different Industries

Generative AI has already demonstrated exceptional adoption in a number of areas, and its widespread use in content creation, data analytics, and personalized services is driving continued expansion of market demand and varying degrees of use in different industries.

Salesforce recently surveyed more than 1,000 marketers to get data on how many marketers are using generative AI. The following are some examples of how many marketers are using generative AI:

- Basic content creation (76%).

- Copywriting (76%).

- Stimulating their creative thinking (71%).

- Analyzing market data (63%).

- Generating image assets (62%).

The most common uses of generative AI by sales professionals are:

- Basic content creation (82%).

- Analyse market data (74%).

- Automate personalized sales communications (71%).

The leading generative AI uses among service professionals are:

- Basic content creation (68%).

- Creating and personalizing service communications with customers (68%).

- Increasing automation of customer service communications (67%).

Data Sources: Salesforce

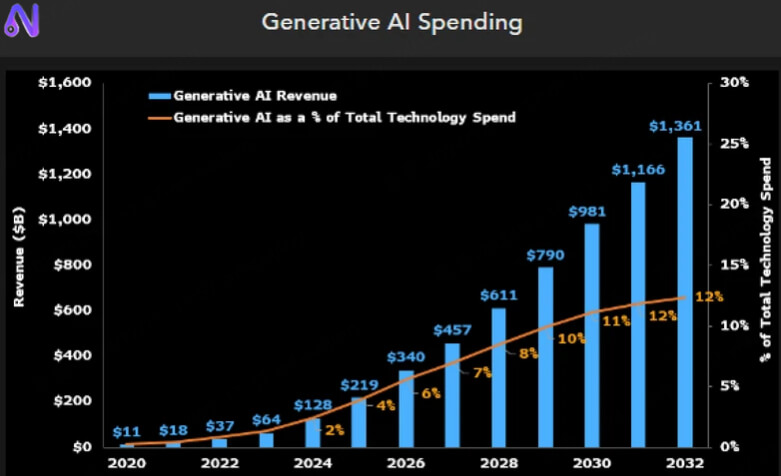

Part 3. Generative AI Market Trends and Dynamics

The impact of generative AI is expected to continue to expand from less than 1% to 10% of total spending on information technology hardware, software, services, advertising and gaming by 2032.

- Generative AI infrastructure-as-a-service for training LLMs will reach $247 billion in 2032.

- Digital advertising powered by the technology will reach $192 billion in 2032.

- Specialized generative AI assistant software will reach $89 billion in 2032.

Data Sources: Bloomberg

Part 4. Generative AI Market Drivers and Challenges

The rapid development of generative AI is underpinned by lock drivers, but also faces unexpected technical, regulatory and ethical challenges. The following section explores the key forces driving the industry, and the main issues that need to be overcome.

Rise in social media platforms as a catalyst for the growth of generative AI market.

With the rise in popularity of social media and virtual advertisements, according to HubSpot survey, around 72% of customers said that they preferred to use tailored content, and this has forced companies to create more engaging content to appeal to their target market.

The generative AI market, although currently showing a booming trend, is actually facing many challenges.

Copyright and Ethical Issues

According to generative AI experts, the use of large datasets has raised a number of questions about copyright infringement, and the ethical consequences of unauthorised use of copyrighted material. For example, the EU's proposed Artificial Intelligence Bill seeks to provide broad controls.

Part 5. The Lates News for Generative AI

The latest developments in the generative artificial intelligence market reflect both technological and market changes. The following will introduce new trends in important collaborations, technology releases, and market placements worldwide.

- In November 2024, Amazon Web Services (AWS) launched the Generative AI Partner Innovation Center in collaboration with partners such as Booz Allen Hamilton and Crayon. The partnership aims to expand the reach of the Generative AI Innovation Center to scale Generative AI initiatives globally.

- In September 2024, IBM partnered with Oracle Corporation, a U.S.-based computer software company, to enhance Oracle customers' use of generative AI by combining IBM's expertise in technologies such as OCI Generative AI, Watsonx, and third-party models.

- In October 2024, Adobe expanded Firefly generative AI to include video, giving creative professionals new tools for generating and editing content in Photoshop, Illustrator, and Premiere Pro.

Data Sources: Grand View Research

In Conclusion

The above data and industry analyses help to provide a deeper understanding of the application, development, and future trends of generative artificial intelligence.

By 2025, the industry is expected to expand into traditional advertising, education, and training, and combine with emerging technologies such as virtual reality (VR), and augmented reality (AR) to create more immersive content experiences and generate more high-quality videos in response to the rapid evolution of generative AI.

-

How to Make AI Cartoon Talking Livestream: From 0 to 1

AI cartoon talking livestream is gradually coming into people's view, bringing new vitality, this post teaches users how to make AI cartoon talking livestream.

8 mins read -

[The Ultimate Collection] 6 Top Cartoon AI Voice Generators

Explore this blog's collection of 6 powerful cartoon AI voice generators,and you can easily create voiceovers by yourself for a wide range of cartoon types.

11 mins read -

From Cartoon to Realistic AI Software: For PC and Mobile

What it would be like if the Simpsons became a real person, using cartoon to realistic AI in our article, you can transform the cartoon into a real look.

11 mins read -

Use Steve AI to Make a Cartoon & It's Best Alternative Tool

You are exploring AI to make cartoon, and found Steve AI but don't know how to use it, now we provides a detailed tutorial on using Steve AI to make a cartoon.

7 mins read -

[All Ports] 13 Happy Birthday Video Makers for PC, Web, App

If you are looking for a tool to make happy birthday video for birthday party, don't miss this collection of happy birthday video makers that cover all port.

3 mins read -

[Finished in 5 minutes] How to Make Birthday Video Easily

Want to make funny or touching videos for anyone's birthday, then don't miss this article, we will guide you extremely well on how to make birthday video.

6 mins read

Was this page helpful?

Thanks for your rating

Rated successfully!

You have already rated this article, please do not repeat scoring!